The 7-Second Trick For Funding Hub

Wiki Article

How Small Business Loans can Save You Time, Stress, and Money.

Table of ContentsConsolidation Loans - An OverviewGetting The Funding Hub To WorkThe 4-Minute Rule for Small Business LoansThe Facts About Small Business Loans Uncovered

It's vital that you go shopping around with several lenders to guarantee you get the most effective bargain on an individual lending. If you go for a loan with the initial loan provider you find, you can get a considerably greater rates of interest than you 'd get approved for somewhere else - https://www.businessfollow.com/author/fundinghubb/. You may get a regular monthly repayment that stretches your budget slim, and also you might pay a number of hundred or countless bucks a lot more in rate of interest over the life of the funding.

The rate of interest, or expense of loaning, is generally established by your credit report and financing term. Lenders have a tendency to market a low-interest rate to attract consumers. However, the most affordable prices are usually booked for customers with outstanding credit. An excellent credit report can additionally obtain you an affordable interest.

You must look for lenders that consider various other elements, like your job background or instructional background, to have a better shot at obtaining an individual loan with an affordable rate of interest price. Does the lending institution fee application, origination or early repayment costs? Depending upon just how much you obtain, these expenses could accumulate rather quickly, also if they're rolled into the lending.

Some Known Facts About Personal Loans.

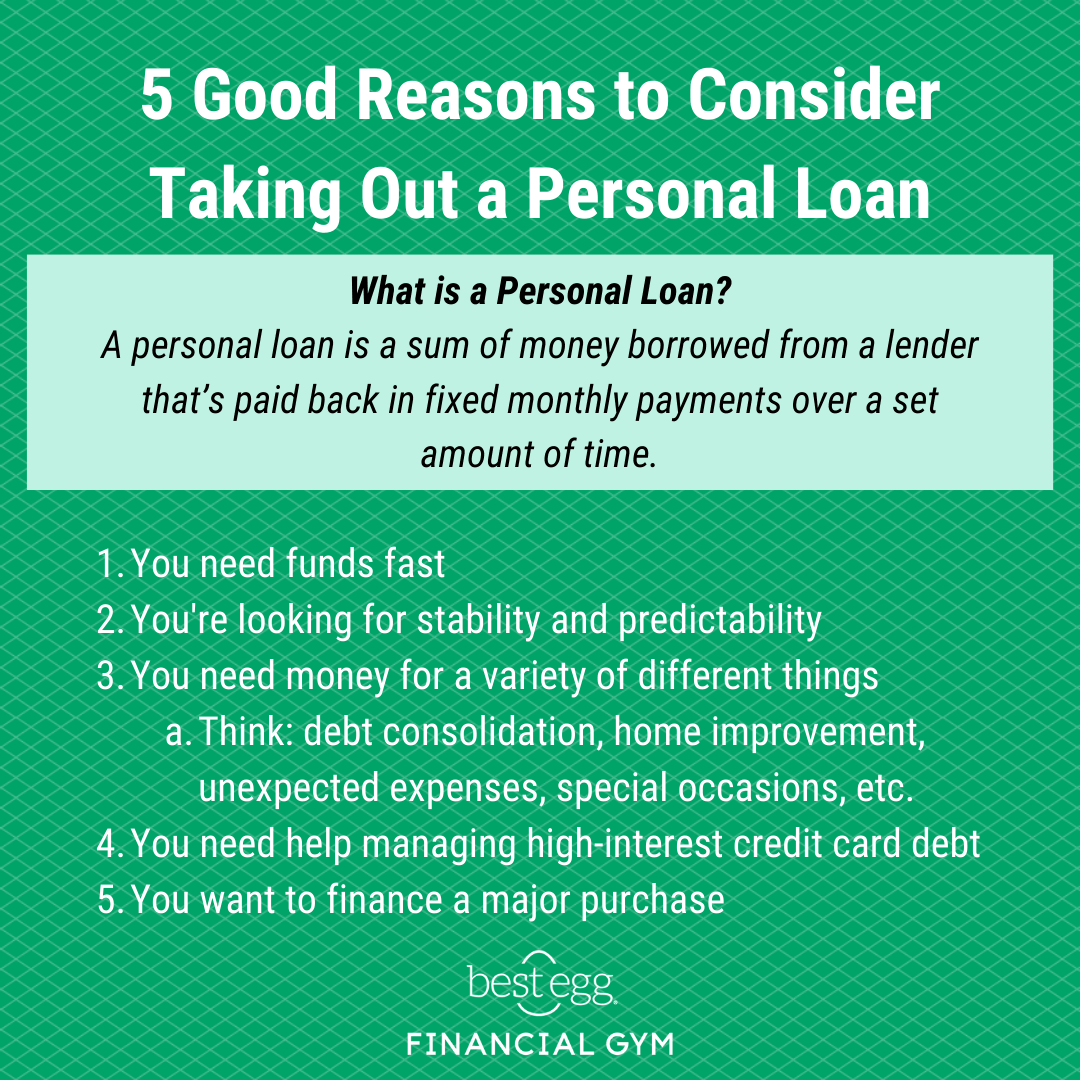

Don't let fees invalidate a certain lending institution, however. In some cases, the loan expenses can still be less even if you need to pay some fees. What are the hours of procedure for the loan providers you're thinking about? Are they readily available by phone, email or chat? Can you see a physical location to obtain aid? These are just a couple of questions to consider as you evaluate loan providers to determine if they're easily obtainable.Personal lendings are either protected (or require security for approval) or unsafe. They additionally feature a set rate that continues to be continuous or a variable rate of interest that changes over time, and also many are marketed for a specific purpose. Usual classifications include: are supplied by lenders to consumers with past credit score obstacles allow you repay multiple financial obligations with a brand-new lending, usually with a lower rate of interest, and streamline the repayment procedure by making a solitary month-to-month repayment are developed to cover unexpected expenses and final economic emergency situations are made use of to make costly upgrades to your home without tapping right into the equity you've built up Ultimately, the solution of the most effective loan provider for you comes down to the loan provider's track record as well as the loan terms they're supplying.

With some research study as well as time, you can arrange from the finest personal loan lending institutions to find the one finest for your circumstance (guaranteed debt consolidation loans).

Obtaining a personal small business loan approved is not the most convenient process. In light of current economic problems across the country, loan providers are searching for a lot extra in a lending applicant and also are much more rigorous. While there are a number of key locations lenders will certainly be focusing on, it is necessary that you prepare to provide the excellent, complete bundle for review if you wish to obtain approved.

The Ultimate Guide To Guaranteed Debt Consolidation Loans

Here are some online personal fundings carriers you can select from: When you locate the car loan package you are most thinking about, get in touch with the bank straight to find out in advance what the demands are for finance qualification. You may need to make a consultation face to face to go over the needed materials, files, and also timelines you will certainly need to get started on the authorization procedure.Incomplete applications can be cause for loan rejection. Once more, looking for a car loan when you're in a hurry is never a good suggestion. Funding policemans have a certain method for authorizing a lending and also obtaining you the cash. Throughout the process, see to it to go over the sequence of occasions, so you'll have an idea of when to anticipate an answer.

Ask the finance officers for guidance on complying with up. Your objective will certainly be to safeguard a financing you have the ways to pay off.

It can be dangerous to your credit rating to constantly obtain simply any kind of lending you believe you may have the ability to get. Way too many car loan applications can spoil your credit rating as well as obliterate your possibilities of small business loans protecting one in the future.

8 Simple Techniques For Funding Hub

Those looking for personal lendings need to initially start their search by coming close to the bank and/or NBFC with which they currently have a deposit and/or loaning relationship. Their passion rates and also other lending attributes can for that reason be made use of as a benchmark versus which rates of interest supplied by various other loan providers can be contrasted.

Lenders provide various rates of interest to different clients depending on various aspects such as credit rating, employer's account and also monthly earnings of a candidate. Some lending institutions also run special rates of interest offers during the cheery season. The candidates having as well as over have higher possibilities of car loan authorization and can fetch lower interest rate (https://www.openlearning.com/u/jamesbuchanan-rensu7/).

Report this wiki page